Taxes are a major source of income for the government and is utilized towards the service of the citizens. While these taxes burn a hole in the pocket of the taxpayers, certain provisions are also at hand wherein one can save tax. One such provision is of Deduction. Deduction reduces your overall taxable income, which lowers your tax liability enabling you to save on taxes. The deduction amount varies according to the type of tax deduction you have claimed.

In my previous posts, I have discussed how tax is calculated and how you can invest and save tax. Some investment avenues came under section 80C. So, in this post, I intend to discuss 80C, so that you can understand and utilize it to minimize your tax liability.

Deductions under Section 80C are the most utilized instruments when it comes to saving taxes. After all, it allows us to save a hefty amount of maximum 1.5 lakhs per year. Do understand that the 1.5 lakh is for the aggregate amount, i.e. the limit is applicable on the combined investment under 80C and not for each investment and expense. So, if the sum of your investments and expenses as per 80C is over 1.5 lakhs, you’ll be able to avail a maximum deduction of 1.5 lakhs only. The deduction is available only to an individual or a HUF (Hindu Undivided Family). Firms, Companies, Trusts are not eligible for tax deductions under 80C. You should also note that you cannot use deductions under 80C to reduce your tax liability because of capital gains. 80C benefits are only applicable on the income from service, profession, and business.

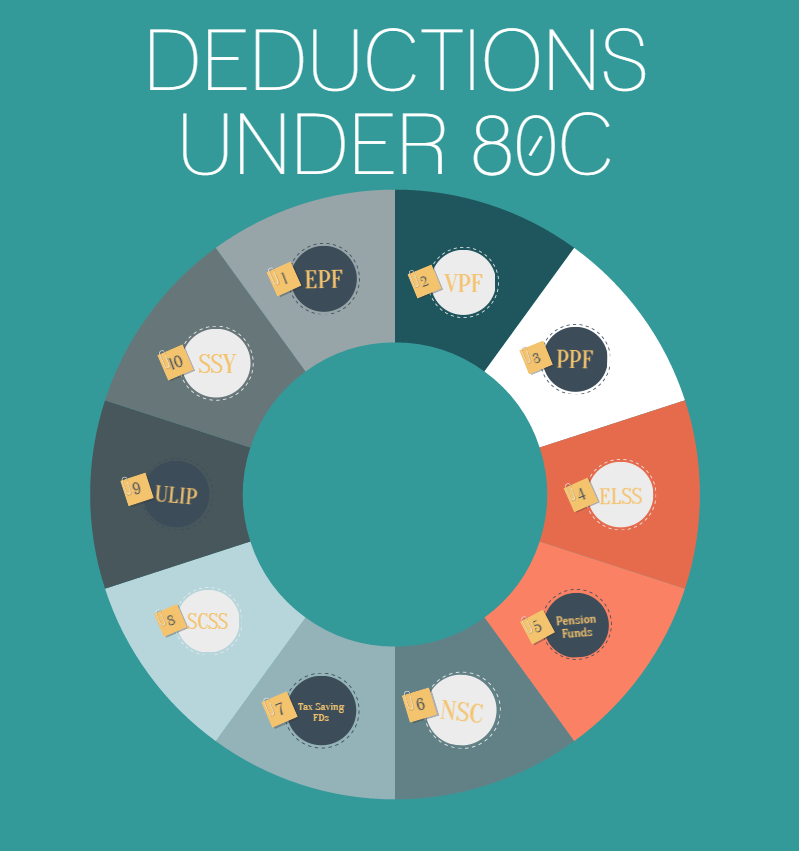

So let’s understand the various deduction avenues available under section 80C.

Investments to avail tax deduction under 80C:

- Employee Provident Fund (EPF): EPF is a saving scheme managed by the Indian Government. The employers’ contribution to provident fund has been capped at Rs. 1.5 lakh a year. Whatever an employer contributes beyond this limit will be subject to tax in the hands of the employee. The employee’s contribution (12% of (basic salary + DA)) is eligible for deduction under 80C. The interest rate currently is 8.65%. However, in order to avail the tax benefits, the employee should be in the continuous service for 5 years without withdrawing EPF.

- Voluntary Provident Fund (VPF): In Voluntary Provident Fund, the subscriber retains the control to periodically assign a specific amount to his/her provident fund, voluntarily. It is an extension of the EPF. The VPF option applies exclusively to salaried individuals who receive their monthly pay through a designated salary account.

- Public Provident Fund: This option is available to people working in organized and unorganized sectors including non-salaried employees. Its interest rate is revised every quarter with the current rate being 8.1% compounded annually. The returns are assured and tax-free as well. It provides the ability to reduce tax liability as the sum invested can be deducted from the taxable income. The minimum amount that has to be invested annually is Rs.500 and since it falls under 80C, the maximum investment can be of Rs.1,50,000. The amount invested gets locked-in for a period of 15 years. However, partial withdrawal can be done from the end of the sixth year onwards. Loan can also be availed from PPF account. Do note that a HUF can’t avail PPF facility.

- Equity Linked Savings Scheme (ELSS): This option invests in stocks, thus is risky. However, over the long term, it gives the maximum returns. Minimum amount to be invested per month is Rs.500 but has no limits on maximum investment. But the maximum amount eligible for deduction is Rs.1.5 lakhs per annum. The dividends and capital gains are tax-free. The lock-in period is 3 years and premature withdrawal is not allowed. Investment can be made through SIP method.

- Pension Funds: There is a separate section 80CCC for investing in the pension funds. But the investment in pension plans is clubbed under the limit of 80C i.e. 1.5 lakh. It means that the total deduction available for 80CCC and 80C is Rs. 1.5 Lakh. These pension plans can be of insurance companies, mutual fund or government’s own national pension scheme. Do note that the annuity payment of pension plan is not tax free. It means the pension payable at old age would be taxable. In the National Pension System money is locked till retirement. Only individual tax payers are eligible for this deduction.

- National Savings Certificates: NSC is a postal saving scheme coming under section 80C. The interest (compounded half-yearly) can be virtually tax free except for the interest that is earned in the last year. Do note that the tenure is 6 years. The maximum investment amount eligible for deduction is Rs.1.5 lakhs. 5 yr NSCs offer an interest rate of 8.8%. 10 yr NSCs have been discontinued.

- Tax Saving FDs: These are like regular fixed deposits having a lock-in period of 5 years. As they come under 80C, the maximum amount eligible for deduction is 1.5 lakhs. The interest earned is taxable and tax is deducted at source. Premature withdrawal is not available. The minimum amount that can be invested is Rs.100.

- Senior Citizen Saving Scheme: Only senior citizens are eligible for this scheme. The current rate of interest is 8.60% per annum payable quarterly. As the interest is payable quarterly instead of compounded quarterly, unclaimed interest will not earn any further interest. The interest is taxable. One can participate in the senior citizen saving scheme after the age of 60. One, who has taken VRS (Voluntary Retirement Scheme or Special Voluntary Retirement Scheme) can join it after the age of 55. There is no age bar for retired defense personnel. Please note that if the money is withdrawn before 5 years, the availed tax benefits will become void and previous years’ benefits will have to be paid back.

- Unit Linked Insurance Plan: ULIPs offer life insurance along with benefits of investment in shares and debts. However, it comes with high charges.

- Sukanya Samriddhi Yojana: Giving an interest rate of 8.6%, per annum compounded annually, this scheme was introduced to promote girl child education. Per girl child only single account is allowed. Parents can open this account for maximum two girl child and should be in the name of the girl child. The account should be opened before the girl attains 10 years of age. In case of twins this facility will be extended to the third child. Minimum deposit amount for this account is Rs.1,000 and maximum is Rs.1,50,000 per year. The money is needed to be deposited for 14 years in this account.

After the investments, let’s focus on the expenses that are covered u/s 80C:

- Life Insurance Premium Payment: The policy must be in the taxpayer’s name or spouse’s or any child’s name (child may be dependent/independent, minor/major, or married/unmarried). For a HUF, it may be on the life of any member of HUF. The 80C deduction is eligible only to extent of 10% of Capital sum assured. Government employees paying premiums to Central Government Employees Insurance Scheme are also eligible to avail the deduction.

- Home Loan Principal Repayment: Home loan EMIs have two components – Principal and Interest. Out of these, only the Principal qualifies for deduction u/s 80C. Loan from relatives is not eligible for deduction. The deduction can be claimed only after possession of the home and the home should not be sold within 5 years after possession.

- Stamp Duty and Registration Charges for a home: The amount paid as stamp duty and for registration of the house document when buying a house, can be claimed as a deduction under section 80C in the year of purchase of the house.

- Expenses towards Tuition Fees: Tuition fees paid to any school, college, university or other educational institution situated within India for the purpose of full time education of any two children (including payments for play school, pre nursery and nursery) can be claimed as deduction u/s 80C. It is allowed on the amount actually paid in the year.

Deductions under section 80C of income tax give you opportunity of financial planning. Having products of fixed return, high return, insurance and retirement planning it provides an opportunity to a middle class salaried person to plan his whole finances.

When it comes to finances, planning and knowledge goes a long way. Be financially literate.